Web3 Series: Haseeb Qureshi on Navigating The Bear Market and The Next Chapter for Crypto

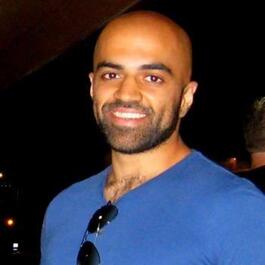

Haseeb Qureshi (@hosseeb), managing partner at Dragonfly Capital, joins Erik for an episode of our Web3 series. Takeaways: - This bear market is driven by macro factors rather than endogenous ones. - It turns out crypto is in fact correlated with other assets, largely because in 2020 institutions started buying crypto. - Projects searching for yield in a yield-starved environment drove growth in crypto. That may change with rising interest rates. - Adoption will drive the next chapter of crypto. Gaming and NFTs will lead the way. - Sometimes boring, stable governance is best. ETH has that today. It’s like Manhattan — it’s old and kind of pricey, but it’s the most important place that things are happening today. - Governments could ban Bitcoin, but they haven’t, likely because it’s not actually all that threatening to them. - Blockchains are like cities. They each have their own unique and vibrant cultures. - More decentralization is not always better in practice. Thanks for listening — if you like what you hear, please review us on your favorite podcast platform. Check us out on the web at www.villageglobal.vc or get in touch with us on Twitter @villageglobal. Want to get updates from us? Subscribe to get a peek inside the Village. We’ll send you reading recommendations, exclusive event invites, and commentary on the latest happenings in Silicon Valley. www.villageglobal.vc/signup

From "Village Global Podcast"

Comments

Add comment Feedback