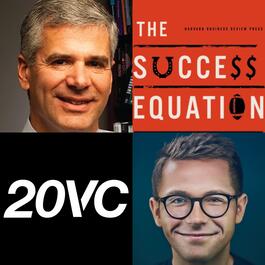

20VC: Michael Mauboussin on Good vs Bad Investment Decision-Making Processes, How To Improve Your Process, How To Know When it Needs Improving and The Single Biggest Mistakes People Make In Their Decision-Making Process

Michael Mauboussin is Head of Consilient Research at Counterpoint Global. Previously, he was Director of Research at BlueMountain Capital, Head of Global Financial Strategies at Credit Suisse, and Chief Investment Strategist at Legg Mason Capital Management. He is also the author of three incredible books, including More Than You Know: Finding Financial Wisdom in Unconventional Places, named in The 100 Best Business Books of All Time by 800-CEO-Read. Michael has taught at Columbia Business School since 1993 and received the Dean's Award for Teaching Excellence in 2009 and 2016. In Today's Episode with Michael Mauboussin We Discuss: 1.) Entry into Venture and Finance: What does Michael actually do as "Head of Consilient Research"? What does Michael know now that he wishes he had known when he entered finance? How did Michael and Bill Gurley meet in business school? What does Michael believe makes Bill such a special investor today? 2.) Booms and Busts: How This Compares? How does the current macro downturn compare to prior crashes Michael has worked through? What is the same? What is different? How do political and health events impact the macro? Why was 1987 the end of the world at the time? How did the recovery take place? How does Michael analyze the duration of bull markets vs the duration of recovery time? What advice does Michael give to young people today questioning if they are good investors? 3.) The Investment Decision-Making Process: How does Michael advise on the structuring of your decision-making process? What makes a good process vs a bad process? What can be done to remove politics from the decision-making process? What can be done to ensure all people, regardless of hierarchy feel safe in the process and feel they can share their thoughts without repercussions? What are the single biggest mistakes Michael sees people make in their decision-making process? How do you know when is the right time to change your process? 4.) Everything is a DCF: What does Michael mean when he says that "everything is a DCF"? How does Michael advise and apply this thinking to early-stage venture investors? How does Michael think through highly diversified portfolios vs super concentrated portfolios in venture? Items Mentioned in Today's Episode: Michael's Favourite Book: Consilience: The Unity of Knowledge by E.O Wilson

From "The Twenty Minute VC (20VC): Venture Capital | Startup Funding | The Pitch"

Comments

Add comment Feedback