"Putin’s Going To Want To Be Looking For Some Saving Of Face" With Senator Hutchison & Jack Balagia

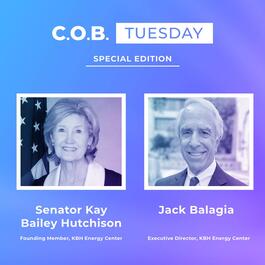

We were honored this week to welcome Senator Kay Bailey Hutchison and Jack Balagia for a Special Edition COBT. Senator Hutchison is a Founding Member of the KBH Energy Center at the University of Texas, with a distinguished career spanning both public and private sectors, from bank executive to U.S. Senator to most recently U.S. Ambassador to NATO. Jack served as Vice President and General Counsel of ExxonMobil for nearly two decades before joining the University of Texas School of Law faculty. He was appointed as Executive Director of the KBH Energy Center in 2024. We were thrilled to visit with Senator Hutchison and Jack about the KBH Energy Center’s upcoming Symposium in September and also hear their unique perspectives ahead of Friday’s significant meeting between President Trump and President Putin. This year’s KBH Energy Center Symposium will focus on the future of energy innovation, investment, and security (agenda details linked here). Taking place Friday, September 12 in Austin, the program will cover global energy outlooks, the growing role of nuclear and AI, energy’s ties to national security, data infrastructure demands, capital markets, and media coverage. In our conversation, we explore the geopolitical backdrop of the upcoming Trump-Putin meeting in Alaska, the hope for a Ukraine ceasefire, and the implications for future negotiations involving President Zelensky and the EU. We discuss shifts in President Trump’s stance on Putin since the start of his second term, as well as the Symposium’s keynote from ExxonMobil CEO Darren Woods, the event’s audience profile and impact, and other notable speakers including Goldman Sachs Vice Chairman Rob Kaplan and investor Jim Breyer. We touch on the uniqueness of the Energy Studies Minor Program at the University of Texas (details linked here), the Center’s collaboration with more than 30 energy-affiliated organizations on campus, NATO unity under Trump, changing European attitudes on defense burden-sharing with the U.S., and European relief at U.S. military action to deter Iran nuclear weapon capability. Senator Hutchison shares her perspective on how Putin may have overplayed his hand by not striking an early deal with Trump, the potential for stronger measures against Russia, prospects for negotiation, potential outcomes from the Alaska meeting, the symbolism of its location, and more. As you’ll hear, the Symposium is nearing capacity but there is still room to attend. Registration details can be found linked here. We are excited about this year’s gathering and greatly appreciate Senator Hutchison and Jack for joining us. To start the show, Mike Bradley noted that bond and equity markets were focused on the July PPI report, hoping it would match Tuesday’s in-line CPI print and reinforce expectations for an interest rate cut at the September 17th FOMC Meeting. Markets were looking for a PPI print of 0.2%, but instead it came in at 0.9%, the highest monthly reading since July 2022, which pushed the ten-year bond yield up by 5bps (~4.28%). This PPI increase was the first sign since tariffs were implemented that companies were passing through tariff increases and this large PPI print temporarily reduced the odds for a September interest rate cut (especially a 50bp cut) and also looks to have created a short-term headwind for equity markets. On the crude oil market front, WTI price has been drifting lower for the past two weeks, mostly due to global oil supply surplus concerns, which were reinforced this week by bearish 2026 oil macro r

From "C.O.B. Tuesday"

Comments

Add comment Feedback