James Kunstler: Fragility and The Collapse of Complex Societies

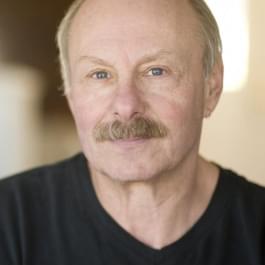

Tom welcomes a new guest to the show James Kunstler. James is a Podcaster, Painter, Author, and writer of the Blog "The Clusterfuck Nation." His book "Living in the Long Emergency" discusses the increasing complexity and fragility of our tech-based society. We seem to be closer to the end than the beginning of this stage of society. The customs and convenience we are accustomed to may go away for a time. We are reaching a point of diminishing returns as systems we depend on fail. The great recession of 2008-2009 and the bailouts were significant but paltry in comparison to the debt added in recent years. The West appears to have vastly underestimated the effects of sanctions. This is because Russia's economy is largely based on real goods and commodities that the West wants. The United States' chief export is the dollar and inflation. Therefore Russia is in a much better bargaining position. The U.S. has managed to blow up global trade arrangements that were deeply complex. The worlds manufacturing processes require fossil fuels and green energy is far from sufficient. Our leaders are operating with a lot of wishful thinking that is failing. We're not going to run suburbia and the interstate highway system on green energy. It's difficult to reach an overall consensus on what is happening and as a result, a plan to fix it is difficult to construct. We should focus on solving issues at a local level. Family-owned businesses are needed that will employ their neighbors. Driving hundreds of miles for goods is not going to be practical. Gold has been money for thousands of years and will remain so. When fiat currencies fail metals reassert their importance. We're seeing the importance of gold in Russia right now. You can either pay them in Rubles or gold and they will sell you Rubles if you have gold. The European countries aren't going to have much choice in the matter. The WEF has created a coordinated system in many Western nations. We see that in the lockstep response to the pandemic. We're experiencing some sort of 'mass formation psychosis' that goes contrary to rationality and reason. China has somewhat stayed on the sidelines through the latest crisis. James believes that the Chinese government and economy may not be that stable. A coming lack of capital investment due to our failing financial system won't help fix the energy deficits. A lot of people who are now rich will discover they aren't that wealthy. Time Stamp References:0:00 - Introduction0:58 - The Long Emergency6:33 - 2008 and Today10:16 - Debt, Russia, & Putin14:26 - Peak Stupidity?18:10 - Green Energy Issues23:50 - Grid Issues & Solutions26:00 - Weather and Farming29:26 - Now What?31:39 - Finding Local Solutions34:22 - Gold, Rubles, and Risk38:00 - Biden, WEF, & Schwab39:38 - Coordinated Crazy?43:07 - U.S. Weakness & China48:34 - Capital & Energy Solutions52:36 - Panic out of dollars?54:47 - Wrap Up Talking Points From This Episode Why our society is becoming increasingly fragile in the age of technology.Massive debts and the actual impact of the sanctions on Russia.Coming energy deficits and the need to return to a more localized economy. Guest Links:Twitter: https://twitter.com/JhkunstlerWebsite: https://kunstler.com James Howard Kunstler says he wrote The Geography of Nowhere, “Because I believe a lot of people share my feelings about the tragic landscape of highway strips, parking lots, housing tracts, mega-malls, junked cities, and ravaged countryside that makes up the everyday environment where most Americans live and work.” Home From Nowhere was a continuation of that discussion with an emphasis on the remedies. A portion of it appeared as the cover story in the September 1996 Atlantic Monthly. His next book in the series, The City in Mind: Notes on the Urban Condition, published by Simon & Schuster / Free Press, is a look a wide-ranging look at cities here and abroad,

From "Palisades Gold Radio"

Comments

Add comment Feedback