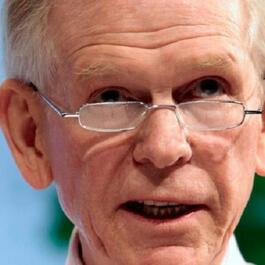

Jeremy Grantham - A Historic Market Bubble

My guest today is Jeremy Grantham. Jeremy is the Long-Term Investment Strategist and Co-Founder at GMO. Jeremy has an encyclopedic knowledge of the history of markets, which made it such a pleasure to have him back on the show. In this conversation, we discuss the three key signs of a bubble, why Jeremy believes we are in a bubble right now and how it’s being led by retail rather than institutional investors. We close with the important role that demographics and productivity will play over the next few decades across the world. Please enjoy my conversation with Jeremy Grantham. For the full show notes, transcript, and links to mentioned content, check out the episode page here. ----- This episode is brought to you by Koyfin, one of the fastest-growing fintech startups. I discovered Koyfin earlier this year when I asked Twitter for the best Bloomberg alternative, and the overwhelming winner was an intriguing new product called Koyfin. Koyfin has tons of high-quality data, powerful functionality, and a nice clean interface. If you’re an individual investor, research analyst, portfolio manager, or financial advisor, you should definitely check them out. Sign up for free at koyfin.com. ------ This episode is brought to you by MIT Investment Management Company. MITIMCO is the endowment office of MIT. New and small investment funds listen up. MITIMCO is looking to find investors starting funds today. MITIMCO is partnership-driven, long-term focused, and has an extensive history of backing investors early in their careers. These partners are key in delivering the outstanding investment returns required to support MIT's pursuit of world-class education, cutting-edge research, and groundbreaking innovation. MITIMCO is focused on finding and partnering with the best investors across the globe, no matter the market environment. No firm is too small, too young, or too non-institutional. If you or someone you know is currently in the process of starting a fund or recently launched, please email partner@mitimco.org or discover more on their website at mitimco.org/partner. ------ Invest Like the Best is a property of Colossus Inc. For more episodes of Invest Like the Best, visit joincolossus.com/episodes. Stay up to date on all our podcasts by signing up to Colossus Weekly, our quick dive every Sunday highlighting the top business and investing concepts from our podcasts and the best of what we read that week. Sign up here. Follow us on Twitter: @patrick_oshag | @JoinColossus Show Notes [00:03:03] - [First question] - His view on the markets today [00:03:07] - Jeremy Grantham’s Podcast Episode [00:08:00] - Proliferation of SPAC’s and how he views them as a potential bubble [00:10:20] - Could SPAC’s help to improve the IPO process [00:14:30] - How he viewed the Gamestop story through his historical context [00:18:24] - Is investor education possible [00:19:50] - How the increasing role of retail investors impacts bubbles [00:24:15] - Attitudes towards market bears in bubbles [00:28:52] - Long term view on the economy and the forces pushing it higher [00:41:50] - Returning to a hard money standard for the US economy [00:49:39] - Would a finite supply of money change market trajectory [00:51:02] - Best ways to improve the infrastructure of the economy and people’s willingness to work [00:53:52] - What should one do if they believe we are in a bubble [00:58:14] - What he is excited about in his green investments [01:02:28] - Advice to young investors

From "Invest Like the Best with Patrick O'Shaughnessy"

Comments

Add comment Feedback