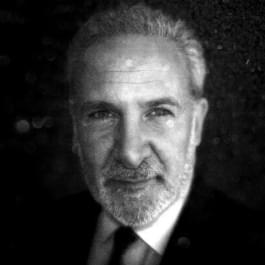

Declining Inflation is Transitory - Peter Schiff #5724

Summary: Financial survival is the name of the game. What can we do now in order to end up on the survivor side when the financial bubble eventually pops? Peter Schiff joins us in this episode to address the core problems of today’s dysfunctional economy, and things to consider in preparation for the downfall of the dollar. Inaccurate inflation measurements, enormous trade deficits, and close proximity to a sovereign debt crisis allude to a looming disaster that we set ourselves up for in various ways. Furthermore, Peter and I discuss ways to stay protected and structure portfolios in anticipation of yet another inflationary spike. As it turns out, there are worse things to be than a gold bug. Tune in for more expert insight. ‘Gold Bugs’ According to OpenAI’s ChatGPT: “‘Gold bugs’ are individuals or groups who are strong advocates for investing in gold. Some of the most well-known gold bugs include: Peter Schiff: A financial commentator and investor who is a strong advocate for gold as a store of value. Jim Rickards: An economist and author who has written extensively about the benefits of investing in gold. Mike Maloney: A precious metals advisor and author who advocates for investing in gold as a hedge against economic instability. David Morgan: A precious metals analyst and investment advisor who has been advocating for gold as a long-term investment for over two decades. Glenn Beck: A political commentator and radio host who has talked about the benefits of investing in gold on his show. These individuals have become prominent voices in the gold bug community and their opinions and advice are widely followed by people who are interested in investing in precious metals.” Useful Links: Financial Survival Network Peter Schiff Twitter

From "Financial Survival Network"

Comments

Add comment Feedback