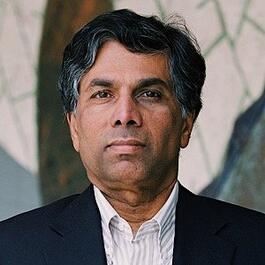

Dr. Dileep Rao is a VC turned Reverse-VC. VCs finance after the 'Aha' moment. As a Reverse-VC, he teaches entrepreneurs to get to Aha! Previously, Dileep financed ventures (~400 deals using equity, debt, leases, development finance) and managed business turnarounds (succeeded on 4/5) . Now he teaches Unicorn-Entrepreneurship: * Small business is about low-growth * Entrepreneurship is about take-off with VC -- but 99.98% of entrepreneurs should avoid VC and the rest should delay. Unicorn-Entrepreneurship (U-E) is about taking off without VC: * VC focuses on opportunities. Reverse-VC focuses on entrepreneurs. * VC focuses on capital. Reverse-VC focuses on skills and smart strategies. * VC funds hot ventures after Aha. Reverse-VC helps entrepreneurs get to Aha * VC helps 20/100,000 ventures. Reverse-VC helps 100,000/100,000. U-E trains entrepreneurs to grow from idea to Aha using the proven skills and strategies of u-entrepreneurs, which are included in his latest books: • Finance Secrets of Billion-Dollar Entrepreneurs: discusses finance and launch secrets of u-entrepreneurs • Nothing Ventured, Everything Gained: discusses opportunity and business secrets of u-entrepreneurs. Dileep learned unicorn secrets by financing entrepreneurs, 9 of whom became unicorn-entrepreneurs, interviewing 33, and analyzing 80. 87 were billion-dollar entrepreneurs (BDEs): • 1% got VC after Tech Aha. 5% got VC after Strategy Aha! These entrepreneurs were replaced by a CEO • 18% used Reverse-VC till Aha. They got VC after Strategy and Leadership Aha and stayed as CEO. • 76% used Reverse-VC, avoided VC, and stayed as CEO. The 94% of BDEs who avoided or delayed VC retained 2x – 7x the wealth created. For more, see “The Truth About Venture Capital” (dileeprao.com). Dileep's previous books were on venture financing, including Business Financing: 25 Keys to Raising Money (NY Times) and Handbook of Business Finance & Capital Sources (AMA, NY). Inc. magazine noted: “Like the U.S. Cavalry, this Handbook enters the scene just in time.” Dileep has consulted on venture development with entrepreneurs, Fortune 500 corporations, economic developers, the U.S. government, and community development corporations to help them bridge the VC gap from Idea to Aha. Dileep has served on boards of many companies and been the chair of one. He has taught entrepreneurship, unicorn entrepreneurship, VC, and venture financing at Florida International University, Harvard, Stanford, INCAE, University of Minnesota and the Warsaw School of Economics.

From "Business podcast"

Comments

Add comment Feedback