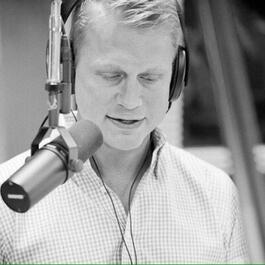

Retire Sooner with Wes Moss

Wes Moss is on a mission: help at least 1 million Americans of any age retire sooner and find joy along the way. A seasoned finance professional, best-selling author, broadcaster, and teacher, Wes has done extensive research on the habits of the happiest retirees. On this podcast, Wes shares key lifestyle and money habits you can implement now to prepare for a secure future while not depriving yourself of happiness in the present. In addition to leveraging his 20+ years of knowledge as an investment advisor, Wes brings in guests and specialists to teach you how to set and work towards your financial and lifestyle objectives. Refreshingly-free of mind-numbing financial jargon and unrealistic money goals, Retire Sooner with Wes Moss gives listeners the tools on how to retire sooner in the real world.

Show episodes

Think you might be richer than you realize? In this episode of the Retire Sooner Podcast, Wes Moss and Christa DiBiase examine realistic benchmarks and practical frameworks for retirement planning. • Define what the “rich ratio” means and consider how it may reframe your retirement outlook. • Compare your savings habit

Think you know the rules of thumb for retirement and investing? Think again. On this episode of the Retire Sooner Podcast, Wes Moss and Christa DiBiase examine common money myths and respond to listener questions that may reshape how you approach your financial future. What you'll explore in this episode: • Begin inves

What Every Retiree Needs to Know About Social Security, Trusts, and Retirement Withdrawals

Take the next step in your retirement planning. Tune in to the latest episode of the Retire Sooner Podcast with Wes Moss and Christa DiBiase, where you'll hear thoughtful, real-world insights designed to help you make informed financial decisions and pursue a more confident, purposeful retirement. • Explore ways to opt

In this episode of the Retire Sooner podcast, Wes Moss and Christa DiBiase respond to listener questions and explore practical approaches to navigating retirement, investing, and financial planning. • Discover a common Roth IRA misstep that can lead to unexpected taxes in retirement and learn how to approach it with mo

From FOMO to Focused: Retirement Strategies for Market Volatility and Asset Allocation

In this episode of the Retire Sooner Podcast, Wes Moss and Christa DiBiase explore the role of dry powder assets in retirement planning and revisit “FOMO Freddie”—a cautionary character representing the risks of chasing investment trends without a long-term strategy. 🚀 They discuss why trend-chasing can be detrimental

Keys to Early Retirement: Rule 72(t), New Research, Investing Insights, and Lasting Happiness

Dreaming about retiring early, but worried you’ll never have enough? On this episode of Retire Sooner with Wes Moss, Wes and Christa DiBiase break down powerful strategies and mindset shifts that could help folks retire sooner and happier, including: • Tap Your IRA Early—Penalty-Free: Learn how Rule 72(t) and SEPPs can